Browsing the Intricacies of Payroll Service: A Total Guide for Entrepreneurs

As entrepreneurs endeavor into the realm of managing their services, the intricacies of pay-roll services often provide a maze of challenges to navigate. From deciphering payroll taxes to ensuring compliance with wage legislations, the trip can be frustrating without a thorough guide. One mistake in managing pay-roll can cause costly effects for a blossoming service. In this total guide customized for entrepreneurs, we untangle the complexities of pay-roll solutions, supplying understandings and techniques to enhance procedures and make notified decisions. Join us on this journey to unravel the complex globe of payroll administration and equip your service for sustainable growth and success.

Understanding Payroll Tax Obligations

Companies must accurately calculate and hold back the appropriate quantity of tax obligations from employees' incomes based on aspects such as income level, filing status, and any kind of allowances claimed on Form W-4. Furthermore, organizations are accountable for matching and paying the suitable portion of Social Safety and security and Medicare taxes for every employee.

Understanding payroll tax obligations involves remaining current with tax obligation regulations and guidelines, which can be subject and complicated to change. Failure to conform with payroll tax requirements can cause expensive fines and penalties for businesses. Therefore, services have to ensure they have the understanding and processes in area to take care of pay-roll tax obligations properly and efficiently.

Selecting the Right Pay-roll System

Browsing pay-roll services for business owners, specifically in understanding and managing pay-roll taxes, emphasizes the critical relevance of choosing the best payroll system for reliable monetary procedures. Picking the ideal payroll system is crucial for services to simplify their pay-roll procedures, make certain compliance with tax laws, and preserve precise financial records. Business owners have numerous options when it concerns choosing a payroll system, ranging from hands-on approaches to sophisticated software application remedies.

When selecting a payroll system, entrepreneurs need to take into consideration variables such as the dimension of their business, the complexity of their payroll requires, budget plan restrictions, and the level of automation wanted. Small companies with straightforward pay-roll needs may decide for standard payroll software program or outsourced pay-roll solutions to manage their payroll jobs successfully. On the other hand, larger ventures with even more elaborate payroll structures may take advantage of advanced payroll systems that provide functions like computerized tax computations, straight deposit capabilities, and integration with audit systems.

Ultimately, the key is to choose a payroll system that lines up with business's particular demands, improves operational efficiency, and makes certain precise and timely pay-roll handling. By picking the ideal pay-roll system, entrepreneurs can properly manage their payroll obligations and concentrate on expanding their businesses.

Compliance With Wage Regulations

Making certain conformity with wage regulations is a basic facet of maintaining lawful stability and moral standards in company procedures. Wage laws are created to shield employees' rights and make sure reasonable settlement for their job. As a business owner, it is crucial to remain educated regarding the particular wage laws that apply to your organization to prevent prospective financial penalties and lawful issues.

Secret factors to consider for compliance with wage regulations include adhering to base pay demands, properly classifying staff members as either exempt or non-exempt from overtime pay, and making certain prompt payment of salaries. It is additionally vital to stay up to day with any type of changes in wage laws at the federal, state, and regional levels that may affect your organization.

To efficiently browse the complexities of wage regulations, think about carrying out payroll software program that can help make sure and automate estimations precision in wage payments. Additionally, looking for assistance from lawyers or HR professionals can give beneficial insights and assistance in maintaining compliance with wage legislations. Contact CFO Account & Services for payroll services. By prioritizing conformity with wage legislations, entrepreneurs can develop a foundation of depend on and justness within their organizations

Improving Payroll Processes

Efficiency in taking care of pay-roll procedures is paramount for entrepreneurs looking for to optimize their company procedures and ensure exact and timely compensation for staff members. Improving pay-roll procedures includes executing approaches to streamline and automate tasks, ultimately saving time and minimizing the risk of errors. One reliable way to simplify payroll is by investing in payroll software application that can streamline all payroll-related data, automate calculations, and create reports flawlessly. By leveraging innovation, entrepreneurs can eliminate manual information entry, boost information accuracy, he has a good point and ensure conformity with tax laws.

Furthermore, outsourcing pay-roll solutions to a reliable supplier can additionally improve the procedure by unloading tasks to experts who specialize in payroll management, allowing entrepreneurs to concentrate on core company activities. By simplifying payroll processes, business owners can improve efficiency, precision, and conformity in handling staff member settlement. Contact CFO Account & Services for payroll services.

Outsourcing Payroll Solutions

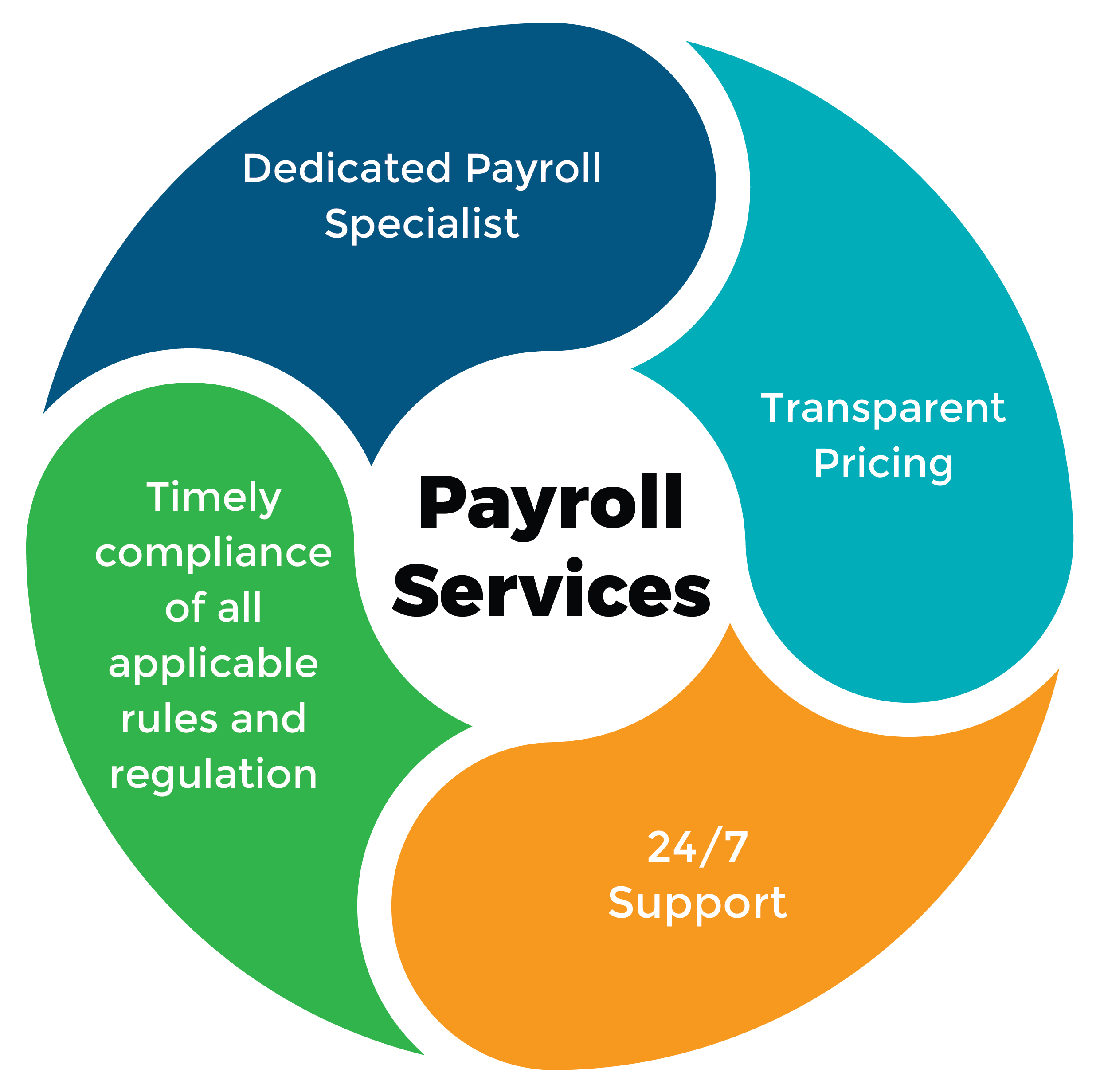

Considering the complexity and time-consuming nature of pay-roll administration, lots of business owners opt to outsource payroll solutions to specialized companies. Contracting out pay-roll services can offer various advantages to businesses, consisting of price financial savings, enhanced accuracy, conformity with tax obligation guidelines, and maximizing useful time for business owners to concentrate on core organization tasks. By partnering with a reliable pay-roll service copyright, business owners can guarantee that their employees are paid precisely and on time, tax obligations are calculated and submitted appropriately, and pay-roll information is securely taken care of.

Verdict

Finally, browsing the intricacies of payroll service needs a comprehensive understanding of pay-roll taxes, choosing the ideal system, sticking to wage laws, maximizing processes, and potentially outsourcing solutions. Entrepreneurs have to thoroughly handle pay-roll to make sure conformity and efficiency in their service operations. By complying with these standards, business owners can successfully manage their pay-roll duties and focus on expanding their company.

Comments on “Open Hassle-Free Payroll Solutions-- Contact CFO Account & Services for Payroll Services”